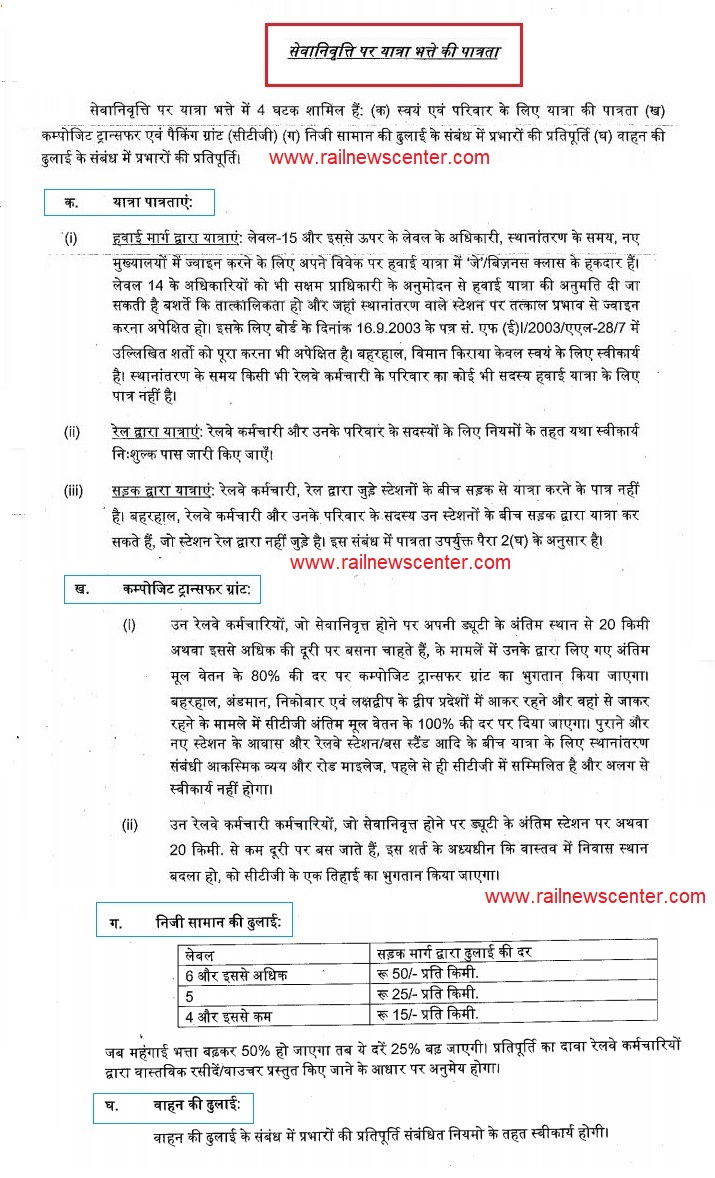

Composite Transfer Grant Rule on Retirement

(सेवानिवृत्ति पर समग्र स्थानांतरण अनुदान नियम)

TA on Retirement includes 4 components : –

(i) Travel entitlement for self and family (ii) Composite Transfer and packing grant (CTG) (iii) Reimbursement of charges on transportation of personal effects (iv) Reimbursement of charges on transportation of conveyance.

(i) Travel Entitlements

Travel entitlements as prescribed for tour/transfer in Para 2 above, except for International Travel, will be applicable in case of journeys on retirement.

The general conditions of admissibility prescribed in S.R.147 will, however, continue to be applicable.

(ii) Composite Transfer Grant (CTG)

(i) The Composite Transfer Grant shall be paid at the rate of 80% of the last month’s basic pay in case of those employees, who on retirement , settled down at places other than last station(s) of their duty located at a distance of or more than 20 km. However, in case of settlement to and from the Island territories of Andaman, Nicobar & Lakshadweep, CTG shall be paid at the rate of 100% of last month’s basic pay.

Further, NPA and MSP shall not be included as part of basic pay while determining entitlement for CTG. The transfer incidentals and road mileage for journeys between the residence and the railway station/bus stand, etc., at the old and new station, are already subsumed in the composite transfer grant and will not be separately admissible.

(ii) As in the case of serving employees, Government servants who, on retirement, settle at the last station of duty itself or within a distance of less than 20 kms may be paid one third of the CTG subject to the condition that a change of residence is actually involved.

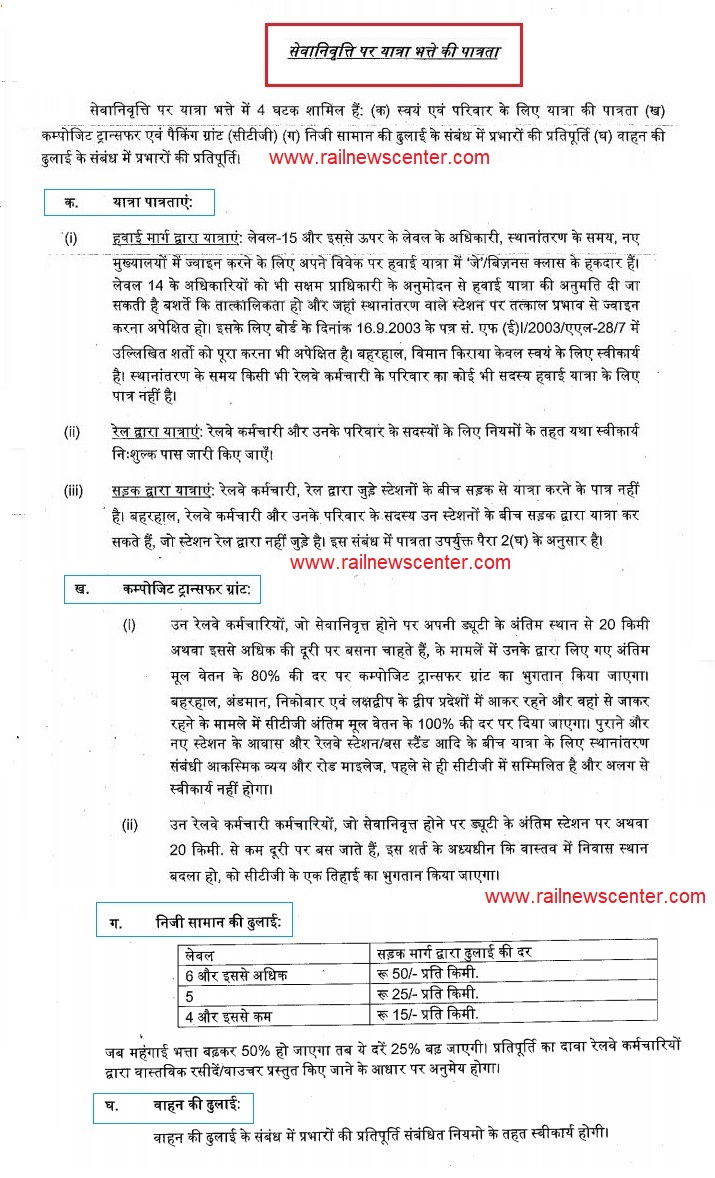

Transportation of Personal Effects :-

| Level |

By Train/Steamer |

By Road |

| 12 and above |

6000 Kg by goods train/4 wheeler wagon/ 1 double container |

Rs.50/- per Km |

| 6 to 11 |

6000 Kg by goods train/4 wheeler wagon/ 1 single container |

Rs.50/- per Km |

| 5 |

3000 kg |

Rs.25/- per Km |

| 4 and below |

1500 kg |

Rs.15/- per Km |

Note – The rates will further rise by 25 percent whenever DA increases by 50 percent. The claim for reimbursement shall be admissible subject to the production of actual receipts/ vouchers by the Govt. servant.

(iv) Transportation of Conveyance :-

| Level |

Reimbursement |

| 6 and above |

1 motor car etc. or 1 motor cycle/scooter |

| 5 and below |

1 motorcycle/scooter/moped/bicycle |

The general conditions of admissibility of TA on Transfer as prescribed in S.R. 116 will, however, continue to be applicable. The general conditions of admissibility of TA on Retirement as prescribed in S.R. 147 will, however, continue to be applicable.

This entry was posted in 2 Railway Employee, 3 Always Important, 4 Railway Circulars / Rule, Railway Pass Rule, Retirement / Pension Tags: Employee, Indian Railway, Railway Board, Retirement, Transfer